Forex Trading Scams

Are you a victim of a Forex trading scam? Are you worried about losing your hard-earned money to fraudulent trading schemes? Have you discovered a forex trading platform with amazing trading options, a free demo account and lucrative financial assets, but it seems too good to be true?!

The forex market is a highly lucrative and fast-paced industry, but it is also a breeding ground for scams. These money-grabbing cons come in various forms, from fake trading software to Ponzi schemes, and they can leave victims in financial and psychological ruin.

For this reason, individual traders have to educate themselves on the dangers of forex trading scams to protect their finances. By understanding the warning signs, you can perform your due diligence and discern legitimate opportunities for actual profits from forex scams.

Keep reading our article to learn how to avoid forex scams and enable yourself the chance to trade forex safely. Together, we can put a stop to these fraudulent schemes and protect investors from forex trading scams.

Is Forex Trading Legitimate?

The Foreign Exchange Market, commonly known as Forex, facilitates a perfectly legitimate form of day trading. It is a decentralized and international financial market where currencies from different countries are traded against each other, thus enabling all participants to buy and sell currency pairs for profit.

These trading systems are practiced regularly by large financial institutions like banks but also by private individuals alike. To prove how popular this form of trading is, just note that forex is the largest financial market in the world. On top of it, it is also the most liquid market, with an average daily trading volume of over $5 trillion.

The main appeal of forex trading is that it allows investors to profit from fluctuations in currency prices, and it can be done anywhere in the world. You just need a computer with an Internet connection. It also offers a high level of liquidity, which means that trades can be executed quickly and at tight spreads. Additionally, all of this is available instantly! Investors don’t need to own stocks or commodities. They can start trading without much fuss.

Enter Forex Market With the Right Mindframe

Sadly, the fact of the matter is fraudulent organizations exploit all of these benefits to trick people into giving away their hard-earned money. The forex market is open to anyone, but this means it’s also open to fraud. Don’t worry, our article can help you avoid forex trading scams.

Any novice trader should take this to heart – Forex trading is not easy money, though scammers would like people to believe this. True, it can be highly profitable, but it also carries significant risk. Losing trades are common, while successful trades take up only 10% of the entire trading practice.

One should keep in mind that profitable trading requires financial knowledge, skill, great foresight, and even a bit of luck. Traders need to analyze news, financial trends, world market trends, and how they influence foreign currencies.

On the other hand, fraudsters will make forex look like easy money. They will promote amazing exchange rates and interest rates, huge profits, incredible returns on the initial investment, forex robots who trade for you, and the list goes on. We will cover the main points of common forex scams in greater detail further in the article.

What Are Forex Scams?

Simply put, forex scams refer to fraudulent schemes that prey on unsuspecting traders in the foreign exchange market. These cons come in various forms, including fake trading sites, fraudulent brokers, and even Ponzi schemes. The common factor, though, is that all of these scams promise high returns on investments with little to no risk.

Generally speaking, forex scams lure and manipulate traders into investing with unregulated or unscrupulous brokers. These organizations or individuals may promise unrealistic ROI or offer trading signals and software that are too good to be true. Sadly, traders succumb to manipulative tactics and consequently transfer money to crooks. Once the trader gives away their funds, the broker disappears with it.

Typical Forex Scam Case

Though each fraud case is individual, and victims can often find themselves in unique situations, the fact of the matter is that scammers operate on well-tried tricks and scenarios. Recognizing the mechanisms of the scheme may be the key to avoiding it, and so we’ll present you with the typical case of a forex scam. Be warned that specific situations, conditions of fraud, or your own experience may differ.

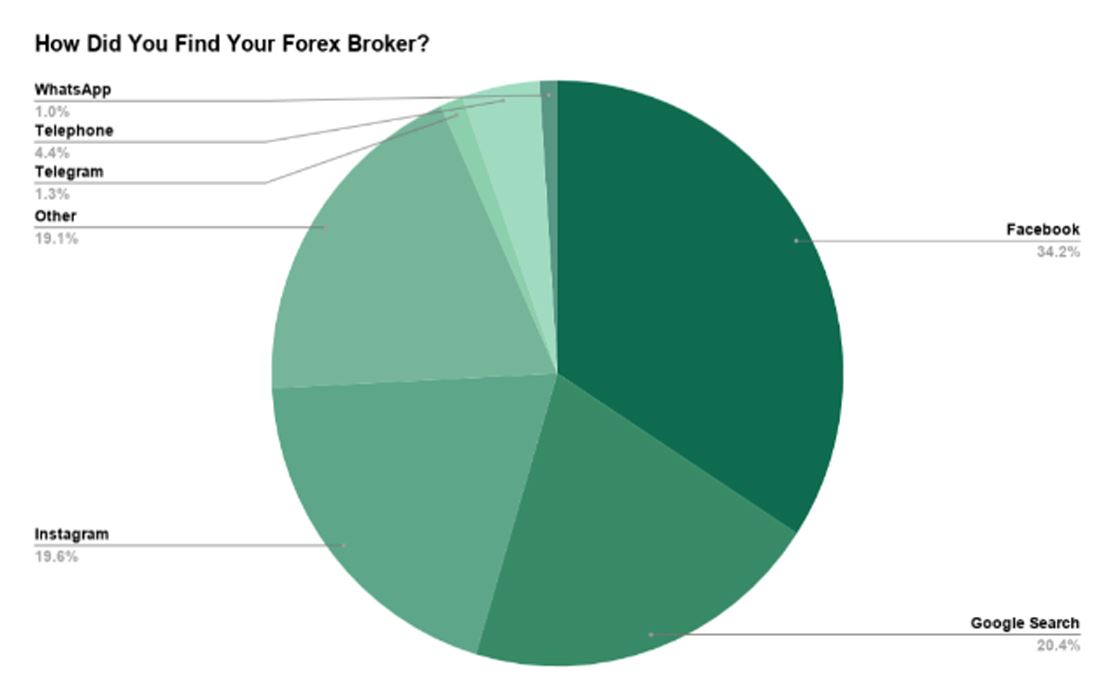

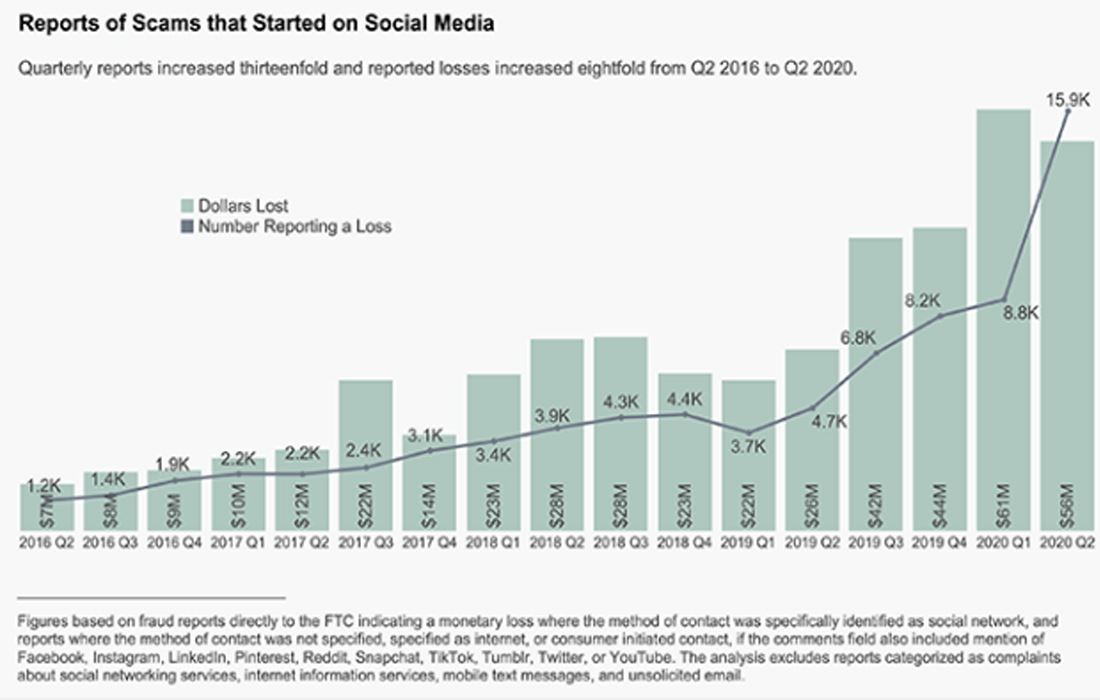

One should understand that scams influence targets much before they come in contact with them. Primarily, fraudsters create fake social media profiles, set up fraudulent trading systems, and sometimes invest in aggressive marketing across the internet. They utilize these assets to practice social engineering and create a false image of being legitimate forex companies. When eventually, someone finds the site or fake social media profile, it looks genuine and reputable.

Regardless of the form the forex scam takes, it dominantly entices its victims with the dazzling promise of an unbelievably large return on investment with a 100% guarantee. Basically, They promote instant vast wealth with no risk whatsoever. They support these claims by feigning financial expertise, state-of-the-art forex robots, insider information, and so on.

At first, the individual experiences small profits, and they might even be able to collect them. This is all for the purpose of reinforcing the insidious illusion that the forex scam is actually working. The victim believes the broker generates wealth, and so they are encouraged to invest larger and larger amounts. However, the moment the person tries to withdraw their money, they realize they can’t. They are met with withdrawal fees and transaction costs, but ultimately they realize their money is gone.

Why Do People Fall For Forex Scams?

The success of most forex scams lies in the exploitation of simple truth – almost everybody wants or needs money. Whether this is motivated by simple greed or because the individual is in a dire financial situation is irrelevant. Scammers abuse this, and they lie about how they can provide easy and quick riches. Many novice forex traders are drawn in by the promise of high returns with little risk, while some people reach for unregulated brokers because they need a steady stream of income.

Forex scams are particularly effective because they use social engineering, false marketing, and exploitative narratives to trap and control their unsuspecting targets. Fraudsters are masters of pressure tactics, emotional manipulation, and FOMO – the fear of missing out.

It’s also important to note that everyone can fall for forex scams. People have a false impression that only gullible and greedy people can get scammed. The truth is, fraudsters use every trick possible to swindle people, and it’s just a question if they find the right tactic for the specific individual.

Most Common Types of Forex Scams

Since forex scams come in various forms, it’s important to be aware of the most common types in order to protect yourself from falling victim to one. In this section, we will take a closer look at the most prevalent versions of forex fraud. Hopefully, with our article, you will be able to spot forex scams easily.

Nevertheless, be warned: scammers are continuously improving their schemes and inventing new ones so they could take advantage of unsuspecting traders. This means you should always take extra caution when searching for the right regulated broker.

Scam Forex Brokers

Out of all forex scams, fraudulent brokers are the most frequent and widespread. These brokers usually take the form of trading sites that emulate the design of legitimate platforms, and also they copy content from reputable sources. Eventually, when a victim visits the site, they believe it’s a genuine financial services agency.

Nowadays, scam brokers rarely deal solely with forex. In order to cast a wider net, they also promote other types of trading. Quite often, a single unregulated broker is commonly a forex fraud, binary options scam, and trading CFDs scheme in one. These scam brokers can also appear as fake social media profiles, thieving forex influencers, and mobile apps. An individual crook may also pose as a licensed financial advisor and contact victims directly via email or phone.

Instagram Forex Scams

Recently, Instagram has become a breeding ground for trading scams. Forex fraudsters set up fake profiles presenting themselves as forex experts with a business background. They flaunt fake credentials, and they fill profiles with photos of trading charts, hefty dollar bundles, luxurious destinations, cars, vapid motivational quotes, and so on. Additionally, they create a large following of bot profiles and leave positive comments so the unsuspecting victim would fall for their lies.

They contact people through social media platforms, promising them exceptional and quick returns on their investment. These scammers typically use persuasive language and high-pressure tactics to convince individuals to invest their money. They give precise instructions and basically coerce the victim into giving away their money. Like many scams, the target has the illusion of gaining profit. However, the moment the victim tries to withdraw their forex fund, the swindler deletes the profile and disappears without a trace.

It’s important to note that these types of scams also target people on other social media platforms like Facebook, Youtube, LinkedIn, and even chat apps like Whatsapp.

Forex Romance Scams

In a sense, this is a mixture of two separate cons. With it, the crooks have synergized the romance scam manipulation techniques with the extortion tricks from forex fraud. Similarly to the previous type of scheme, the swindlers will create fake profiles on social media and chat up targets. They will follow the online dating scam script and shower victims with compliments and affection. When the individual develops an emotional connection with the con artist, then the forex scam part starts.

Normally, in romance scams, the fraudsters will ask for money under the excuse that it would be an investment into a non-existent relationship. In this version of the con, the crooks will entice victims to deposit money into forex fraud. They will use emotional manipulation and lie about how they are giving the victim a chance to gain huge wealth. In reality, they are guiding the targets to voluntarily give away their hard-earned money.

Boiler Room Forex Scams

Fraudulent organizations can set up call centers quite easily and cheaply. These workspaces are colloquially known as boiler rooms, and they consist of sales agents that contact targets via emails or direct calls offering forex trading services. These con people utilize high-pressure tactics and manipulation to entice victims to deposit into fraud.

In the beginning, the fraudsters are in constant contact with their targets, and they are friendly, available, and appearing as helpful. They will lie about how they are generating forex funds for their unfortunate clients. This will excite their victims with unbelievable trade ideas and an exceptional exchange rate. What’s more, they will insist that there is a tight window of opportunity for this once-in-a-lifetime opportunity.

People get hooked on the narrative, and they make deposits believing they are gaining wealth. When the individual can’t give away more funds, and they want to collect their non-existent winnings, the agent shuts down all communication. The victim is left in the dark, coping with the fact they lost their money.

Fake Forex Robots Scams

We live in an age when life-changing revolutionary software gets introduced frequently. For this reason, many people don’t think it’s far-fetched that there is a wondrous program which can predict market fluctuations. This is what scammers exploit – general ignorance of an average Joe and their desire for easy money.

Con artists will fluff up their fraudulent broker scheme by promoting a revolutionary forex robot that works as a prediction software, state-of-the-art AI, or market analysis program. This forex robot has the amazing ability to make lucrative forex trades without any risk. Of course, that is all a lie sprinkled with buzzwords. Forex robot scams present falsified results of trades to create an illusion that they are highly successful and infallible. In reality, they are smoke and mirrors in the form of colourful numbers and graphs.

Signal Sellers Forex Scams

Most people will gladly jump onto the offer of insider information or verified tips when making bets, and crooks count on this. Forex scammers will make their scheme more enticing by advertising trading signals which guarantee profitable trades. These signal sellers often claim to own high-tech algorithms or insider knowledge from central banks.

At first, the fraudsters will do their best to create an illusion that their signals are genuine and that they generate profit by presenting fake numbers to their victims. A signal seller might even charge for their fake service in the form of a monthly fee, thus causing even more financial damage. If the trader takes the bait, they are enticed to deposit as much as they can into the scam.

Forex Ponzi Schemes

One of the oldest types of financial cons from our list is a Ponzi scam, which is quite similar to a pyramid scheme or MLM fraud. It got its name after Charles Ponzi, an American con artist who became infamous for using the technique in the early 20th century. The basic principle is “Rob Peter to Pay Paul.” This means that old members of the system receive returns on their investments from the funds of the newly arrived depositors. The scheme relies on the constant inflow of new investors to provide returns to existing members. In this type of fraud, the same mechanism applies, it just uses a forex trading platform as a front.

A forex Ponzi scheme falsely claims it is generating money for investors from trading, whereas the payments are acquired from other investors. This type of scam often targets individual investors and is commonly promoted through social media or online ads. They utilize pressure tactics and emotional manipulation to make individuals feel like they are missing out on an opportunity of a lifetime.

More importantly, forex pyramid schemes almost always contain affiliate programs. This means that victims are incentivized to recruit more people. Since they are manipulated into believing the scam produces exceptional ROI, they bring new targets willingly. Unfortunately, they commonly expose family members and loved ones to fraud.

Ponzi schemes are inherently unsustainable and are bound to collapse. They are illegal in most countries, and once the scheme collapses, the majority of investors lose their money.

9 Forex Scam Warning Signs

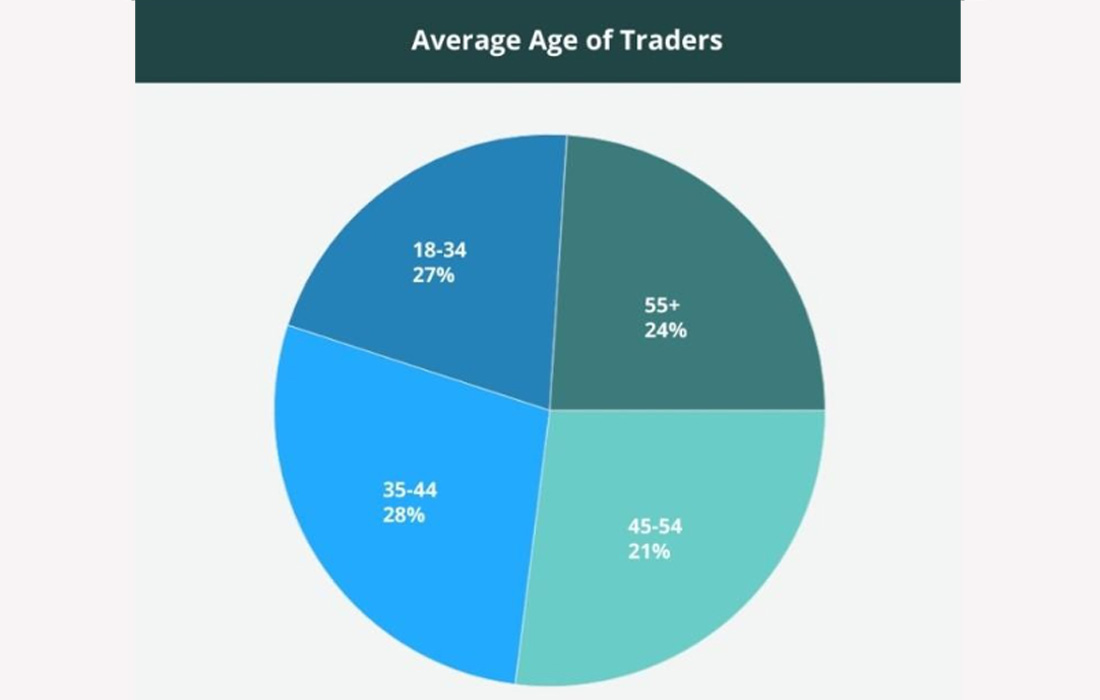

Fraudsters exploit a wide range of weaknesses to execute their scam. They don’t care about age, gender, or people’s backgrounds; they will utilize anything they can to extort money. That is why Forex scams are prevalent and can happen to anyone. What’s worse, con artists constantly find new methods of tricking people.

For this reason, it is important to constantly educate yourself and be aware of the warning signs. This way, you can proficiently perform your due diligence and avoid scams. This section will list and explain the most common red flags to watch out for when considering investing in the forex market.

Bonus Trading Credit and Bonus Money

This is a common tactic to entice individuals to open an account and invest their money. Scammers offer bonus trading credit or fake money for opening an account, but in reality, these gifts are just a way to lure in unsuspecting victims. These funds are non-existent, while the victim deposits real money.

The Broker Gives Instructions and Pressures into Trades

Legitimate forex trading platforms are legally forbidden from providing instructions and depositing money for the trades in their clients’ names. However, fraudsters will utilize a range of manipulative tactics, including pressuring their victims and creating FOMO, so the targets would willingly give away their money.

Automatic Trades

Fraudulent forex brokers advertise software and systems that can make automatic and risk-free trades. Traders don’t have to do anything, and the platform makes them rich. If this sounds too good to be true, it is. No regulated broker can allow such trades, so stay away from them.

The Broker is Unregulated

In order to conduct their business, all trading platforms must be regulated by the official institution of the country they are operating in. This is why all scam brokers are unregulated. Be warned, the site might falsely present they have official stamps of approval. Don’t trust what you see on the platform, check the name of the broker directly on the official page of the regulatory institution.

Steep Transaction Fees and Withdrawal Charges

Various scams impose huge charges in case the target wants to collect their money or earnings. This is a typical tactic to discourage victims from accessing their funds. This way, they can go through long periods depositing more and more money without realizing it is being stolen. Be wary of any broker that makes it pricey to withdraw money.

Difficulties with Withdrawal

Similarly to previous scam tactics, this is also a way of discouraging victims from trying to collect their funds. Truth be told, some international platforms do require a day or two to execute transactions. However, if an individual waits several days or weeks to receive their own money, that’s a huge red flag.

Online Warnings

Luckily, there are many online spaces where scam victims can leave their complaints and experience. Visit forex forums, official anti-scam sites, anti-fraud social media groups, and pages of regulatory bodies. Look for reviews, testimonials, and comments. Chances are there will be either official warnings or victims’ complaints. To help you, we provide the list of official government sites that issue warnings against scams:

- USA – Commodity Future Trading Commissions

- Britain – Financial Conduct Authority

- Australia – ACCC ScamWatch

- South Africa – Southern African Fraud Prevention Service

- Canada – Canadian Anti-Fraud Centre

- New Zealand – New Zealand Scamwatch

Only Paid in Cryptocurrency

Since crypto can be transferred across the world shortly, and also wallet holders can stay perfectly anonymous, scammers prefer to extort funds in cryptocurrency. That’s why, today, multiple schemes function as cryptocurrency scams. You should avoid a forex broker which solely accepts deposits in popular Cryptocurrencies like Bitcoin or Ethereum.

Fake Celebrity Endorsement

Slap a celebrity face on a product and it sells more: Scam brokers exploit this. It might seem like a simple trick, but forex trading scams often use pictures of famous people to deceive targets. Crooks will fabricate how the celebrity is promoting or using their scam broker. As a result, many people, believing they are following the footsteps of their favourite star, deposit their money into a scam broker.

FAQ

Is forex a scam or legit?

Yes, the foreign exchange market is a perfectly legal and legitimate financial platform that enables investors to practice currency trading worldwide. Regrettably, though forex is a tightly regulated and lawful financial practice, the overall landscape is filled with forex broker scams.

Roughly speaking, for every trusted broker, there are over a hundred trading forex scams. What’s worse, the moment one forex scam gets exposed and disappears, several new ones replace it. That is why you should read the advice and tips on our page carefully and it will help you avoid forex scams.

What is the procedure for returning Money?

You can easily start your road to financial justice by simply leaving your contact information on our site, and you will receive a free consultation. Should our case coordinators evaluate your case has a strong chance of success, only then, equityrestitutiongroup.com.com will accept it.

Afterward, case agents perform a thorough investigation and collect evidence to back your case. Along the way, we evaluate official financial bodies which are liable and which showed gross negligence and so contributed to the fraud. Then we dispute your charges and bank transfers with these institutions to ensure you regain lost funds. Don’t hesitate and contact us to schedule your free consultation.